THIS WEEK ONLY: SAVE 50% ON ENROLLMENT!

The Good Steward:

A High-Touch Financial Coaching Program for the Faith-Based & Ambitious

90 Days from Today, You Could Be Making More, Keeping More, and Finally Feeling at Peace & in Control of Your Money.

Our step-by-step strategy, 1:1 guidance, and community of go-getters will help you set up a stress-free money system, make & save more, and invest strategically to build lasting wealth without sacrificing things that bring you joy…

Because you deserve to enjoy your life now, not “one day.”

Special Offer Expires In:

"I Work Hard and Make Good Money... Why Do I Still Feel Behind?"

Sound familiar? I hear this all the time.

It usually goes something like this:

You’re better off than most people, but somehow, you’re still...

❌ Trading hours for dollars and watching it all vanish

❌ Stressing every time you log into your bank account

❌ Watching inflation eat away at your savings

❌ Telling yourself you’ll start investing “when you make more”

❌ Wondering where all your money is actually going

❌ Feeling a little envious when you scroll social media

❌ Frustrated that no matter how much more you earn, the freedom you crave still feels out of reach

It feels like no matter how much comes in, it’s not making a real difference at the end of the day.

You don’t feel any happier, at peace, or closer to freedom.

You’re working way too hard for a life that feels restricted instead of abundant.

Friend, you were meant for so much more than to spend your precious time and energy worrying and stressing over money.

God created you for a bigger purpose.

So let's trade that stress for peace of mind and swap the rat race for a life of freedom and fulfillment.

It’s time to master your finances and start building the abundant, purposeful life you know you were meant for.

What If You Never Felt Stressed About Money Again?

What would your life look like if money was working in your favor instead of controlling you?

Would it look like…

✅ Planning a last-minute getaway to the mountains with your family, knowing you don’t need to check your bank balance or dip into savings to make it happen

✅ Reducing your work hours to have slow, peaceful mornings at home sipping coffee on the porch while watching the sunrise

✅ Being in full control of your schedule so you can coach your kid’s soccer team or take a mid-weekday trip without worrying about missing the hours

✅ Investing in opportunities like starting a business or building a real estate portfolio without sacrificing your quality of life, because your finances can handle it

✅ Going to dinner with a friend, covering the tab, and leaving a tip so generous it makes your waiter’s day (or maybe even week)

✅ Hosting holiday dinners in your dream home with room for everyone and a kitchen big enough for all the chaos that comes with it

✅ Giving generously to causes you care about – supporting your church, helping families in need, or funding missions (without needing to cut your budget elsewhere)

If this is what you want, but you don’t know how to get there…you’re in the right place.

Becky Aste had 3 consecutive record-breaking income months (including a $40k month)

Julie Brumley raised her credit score by 100 points and actually looks forward to budgeting every month

Cami Ashley saved over $10k, eliminated $5k in debt, and created $5k in additional monthly revenue

And one of my personal favorites...

One of our clients saved $25,000, paid off $30,000 in debt, and invested over $100,000 in the stock market.

Her family now has empowering, healthy conversations about money, she’s running a business that generates $30k per month…

And more importantly – for the first time, she felt at peace taking time off for Christmas while still giving generously to her church.

That’s the kind of peace and fulfillment I want for you.

Ever have those moments when you pause and think…

“What Am I Working So Hard For?”

We’ve all heard the stories of people at the end of their lives reflecting on what mattered most.

And one of the top 3 regrets is, “I wish I hadn’t worked so hard.”

It makes you wonder…

→ At the end of your life, will you be proud of how you spent the resources God entrusted to you?

→ Did you spend your time on what truly fulfilled you and made a lasting impact?

→ Did you chase money, or did you treat it like what it is – a tool meant to serve you?

Because money isn’t the goal, it’s simply a tool.

It’s a powerful (and neutral) resource you can use to create freedom, build a meaningful life, and give generously to the people and causes you care about.

What are YOU working so hard for, friend? And is it getting you closer to the life you desire?

The Good Steward was built to help you get there.

We’re not here to just “sell you something.”

We’re here to help you take full control of your finances and learn to be a wise steward so you can create freedom, build wealth, and focus on what truly matters to you.

We’re here to help you build a life lived well.

Most People Try to Work Harder and Earn More…But That’s Not the Real Problem.

If making more money was the answer, you’d already be living your dream life.

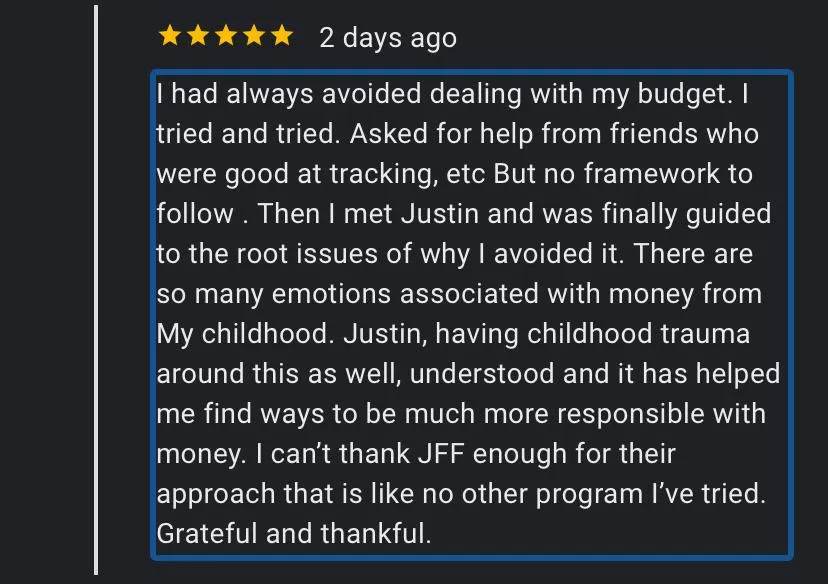

The real problem is that no one – not even your “financial advisor” dad – ever taught you how to actually manage, save, and grow your money.

Without the right mindset, systems, strategy, it doesn’t matter how much you make – it’ll always feel like money slipping through your fingers.

That’s where we come in.We don’t just teach you “how to budget” or give you a list of affirmations to repeat all day long.

We show you how to completely shift the way you think about, feel about, and handle your money…

So you can see all the same wins our students do in the next few months:

✅ Saving $1000s by optimizing their finances and spending smarter

✅ Paying off debt faster than they ever thought possible while still enjoying life

✅ Building additional income streams that don’t require trading time for money

✅ Raising their credit scores and feeling confident about their financial future

✅ Breaking free from financial stress and experiencing true peace of mind around money

✅ Developing healthy money habits and overcoming limiting beliefs that have held them back for years

✅ Gaining the tools and confidence to invest in their future and create lasting wealthBut these transformations aren’t just about money…

Our students aren’t just saving money or paying off debt.

They’re becoming the kind of people who handle their finances with confidence, peace, and intention.

They’re creating strong financial foundations that allow them to give generously, build wealth for future generations, and live the lives they know they were meant for.

Money is just the tool. Freedom is the goal.

“I've witnessed more shifts in 3 weeks working with Justin than in the last 2 decades taking financial courses, meeting with various advisors, attempting to track my budget, and still stuck in this anxious, stressed-out scarcity mindset no matter how much our income increased over the years.”

– JFF Client, Becky A.

Introducing:

The Good Steward

Increase Your Savings, Slash Your Debt, and Grow Your Investments in 6 Months So You Can Stop Stressing About Money and Start Living Life on Your Terms.

A 6-month financial coaching membership for ambitious faith-based individuals.

Get the strategy, 1:1 guidance from a dedicated success coach, and a supportive community of go-getters to master your money mindset & skills and achieve financial freedom faster than you ever thought possible.

We’ll Hold Your Hand & Walk You Through the 4 Steps to Financial Freedom:

☑️ Step 1: Build Rock-Solid Financial Systems

Managing your money once a week or relying on an accountant isn’t enough. We give you a personalized system that runs daily in just 1-3 minutes and it’s so simple a third grader could follow.

At the same time, we’ll work on rewiring your mindset around money because financial freedom isn’t just about numbers – it’s about how you think and operate.

Your external wealth is a direct reflection of your internal beliefs. If you carry fear, doubt, or scarcity around money, it’ll show up in your bank account. In this step, we help you shift from financial stress to financial confidence so you can attract, manage, and grow wealth with ease.

☑️ Step 2: Give Your Money a Mission

Money without a plan disappears fast. That’s why we design a personalized strategy based on your unique financial situation, goals, and priorities. No cookie-cutter advice or generic “pay off all your debt first” strategies.

We help you answer questions like:

Which financial goals should I prioritize first?

Where should I focus your income for the fastest results?

How can I make financial progress without sacrificing the things I enjoy?

This is the kind of custom strategy you won’t find on Google, YouTube, or from your CPA or financial advisor… because most professionals focus on theory, not results. We focus on what works for YOU.

☑️ Step 3: Make More Money (The Right Way)

Most people think making more money will solve their financial struggles. But without the right systems and habits, more income just creates more problems. That’s why we don’t start here – we build a strong foundation first.

Once you’re managing your current finances correctly, it’s time to increase your income. In this step, we show you:

How to make more money in ways that align with your skills and passions

The best strategies to increase profit, not just revenue

How to scale your income without sacrificing time and freedom

We don’t just teach you how to make more, we teach you how to keep more.

☑️ Step 4: Multiply Your Money & Build Lasting Wealth

Now that you’ve increased your income and have more left over, it’s time to put that money to work. In this final step, we show you how to:

Invest and multiply your income strategically

Create additional income streams that grow without requiring more of your time

Build financial security that withstands economic downturns

This is how you become financially unshakable – you don’t stress when business is slow, the economy shifts, or unexpected expenses pop up.

Instead of constantly worrying about money, you’ll know you’re secure, no matter what happens.

Ready to feel confident, secure, and financially unshakeable?

Imagine Knowing Your Money is Working Harder than You Do...That’s Our Goal.

Before THE GOOD STEWARD:

You’re making good money, but every month feels like déjà vu: paycheck comes in, bills go out, purchases are made, and there’s not much left to show for it.

You trade hours for dollars, working relentlessly only to watch inflation eat away at your hard-earned money, making it feel like you’re running on a treadmill that’s speeding up while you stay in the same spot.

Every unexpected expense – an ER visit, a car repair, your kid’s sports fees – feels like a gut punch, leaving you feeling like you’re 2 steps behind again.

You know you should be investing, but it feels risky and overwhelming and you don’t know who to trust, so you just keep putting it off.

You watch friends buy dream homes, take epic vacations, and invest in opportunities…meanwhile, you’re working just as hard (if not harder) and wondering why you’re still stuck in the same place.

You wonder, "Why am I working this hard if I still have to stress about money?"

After ThE GOOD STEWARD:

Your paycheck isn’t slipping through your fingers, it’s stacking up in savings, paying down debt fast, and flowing into investments that grow on autopilot.

Unexpected expenses? No sweat. When the AC breaks or your kid needs braces, you’ve got the cash to cover it without touching your emergency fund.

You know exactly where your money is going before it even hits your account. No more guessing, no more guilt, no more hoping it all works out.

You’re investing with confidence and watching your money multiply instead of sitting around depreciating in your savings account.

Bills are paid, the stress is gone, and you feel at peace about your future, in control of your money, and confident in every decision you make.

You’re not just earning, you’re building something – a financial foundation strong enough to fund the life you actually want without waiting decades to enjoy it.

What Do I Get When I Join The Good Steward?

Monthly 1:1 Sessions with Your Client Success Coach

Your dedicated success coach will hold your hand, answer all your questions, and coach you to help you stay on track, overcome challenges, make smart decisions, and achieve your financial goals in the fastest way possible.

Bi-Weekly Group Coaching Calls

Join live sessions with our team and other members for expert insights, accountability, and actionable advice, plus a chance to connect with ambitious individuals like you.

1:1 Financial Strategy Session with Our Executive Coach

You’ll start your journey with a 90-minute deep dive with a coach to create a step-by-step plan for your top financial goals so you feel clear and confident about where you’re going and how you’ll get there.

14-Module Money Mastery Course

Self-paced, actionable lessons covering everything you need to master your finances and build lasting wealth.

Exclusive Training Library

Hungry for more? Access over 3 years of recorded trainings and coaching sessions designed to optimize wealth-building and business strategies.

Resource Library

Done-for-you tools proven to work including budgets, balance sheets, and planners, to streamline your financial management and remove the stress and guesswork.

Exclusive Community

Connect with a supportive community of like-minded individuals and our team and get ongoing support, inspiration, and a place to share your wins. (We might be biased, but we genuinely think this is the most incredible community on the planet!)

...That's Not All! You ALSO Get:

Access to a Financial Advisor

Get expert guidance to build and optimize your investment portfolio with confidence.

Access to a Business Lending Expert Support

Learn how to build business credit and access funding to grow your business.

We’ve covered every base possible to make sure you never feel lost, overwhelmed, or confused...

And are 100% confident in every step you take, knowing it’s getting you closer to the life you deserve.

TOTAL VALUE: $30,000+

PRICE FOR 12 MONTHS: $12,000

But if you join before Saturday, you get 12 months of access for...

YOUR INVESTMENT: $6,000

Meet Your Success Coaches

Justin Buonomo,

CEO & Founder

In January 2022, Justin and his wife Lauren achieved financial freedom largely from scaling JFF to a 7-figure company in only the second year of business through good stewardship and quality money management. He teaches intentional live lessons packed with expert level content but easy enough to apply for anyone in attendance.

Brittnie Brauner,

President & Executive Coach

Brittnie has been in the coaching world for over 5 years. Her greatest mission with JFF is to guide and encourage people to a life where they don't just make good money but to live a life where it works for them and brings choices into their lives that used to be dreams.

"Is The Good Steward for Me?" Let’s Find Out…

Your results are our priority, so this program isn’t for just anyone. But if any of this sounds familiar, then it’s for you.

You’re making good money (either in a job or your business), but you don’t feel like you’re getting ahead…at least, not fast enough.

You work hard, but your savings aren’t growing fast enough, your investments feel random, and you don’t know who to turn to for help and reliable advice.

You know there’s a better way to manage, grow, and multiply your money, but you don’t have time to sift through all the conflicting advice online or take some cookie-cutter course that might not even apply to you.

You’ve tried budgeting, investing, and cutting expenses, but you still feel like you have no idea what you’re doing.

You’re not looking for a one-size-fits-all course – you want personal guidance and tailored support so you can make every financial decision with confidence.

We’re not just blowing smoke when we say…

It Costs You More NOT to Join The Good Steward.

What’s the real cost of staying stuck?

Another 6-12 months of:

Making good money but still feeling behind

Watching your savings grow painfully slow

Worrying about debt and expenses instead of feeling in control

Wasting more time and money figuring it out on your own

Seeing another year slip by without real progress

Not having good money management bleeds you energy, time, and money.

Without a clear roadmap, the next 6 months might look very similar to the last.

Now, let’s say you join the program and you…

Save $500+ a month by cutting unnecessary expenses, optimizing debt, or using smarter budgeting tools. That’s $3,000 saved in 6 months (our students increase their savings by an average of 50% after 90 days)

Decrease bad debt by 50% within 6 months (our students consistently achieve this milestone)

Increase your investments by 30% over the next year (many of our students see this kind of growth within 12 months)

And while we can’t promise these results (because they ultimately depend on you), it’s easy to see how the program could pay for itself and then some.

With proven strategies, a supportive community, and 1:1 guidance from a dedicated client success coach…

It’ll be hard not to make your money back.

Plus, you’ll gain priceless knowledge that will help you save smarter, grow faster, and invest wisely, setting you up for a lifetime of freedom and abundance.

So, the only question left is…

How much longer can you afford not to master your money?

Frequently Asked Questions

How do I know if this program will work for me?

If you’re making close to or over 6 figures but still feel like you’re not getting ahead fast enough, this is for you.

JFF is designed to help you optimize your finances, save more, invest wisely, and take full control of your financial future without having to figure it out alone. We give you the exact steps, tools, and coaching to make real progress, no matter where you’re starting.

I’ve tried budgeting, cutting expenses, and even investing but I still feel stuck. How is this different?

Most people approach money management in pieces, but what you need is a holistic system that helps you track, manage, and grow your money strategically.

JFF doesn’t just give you a budget, it helps you design a full financial strategy that aligns with your life and long-term goals. This means knowing exactly where your money is going, how to optimize it, and how to make every dollar work in your favor.

Is this a glorified budgeting program?

No – it’s a complete, hands-on financial transformation program. Budgeting is just one piece of the puzzle. Inside JFF, we teach you how to build a budget that works for your life, eliminate wasteful spending without sacrificing what you love, and allocate your money in a way that builds wealth.

You won’t just track your spending, you’ll take full control of your finances and learn skills that will last you a lifetime and help set up future generations for success.

I already work with a financial advisor. Why do I need this?

Most financial advisors focus on investments…but what about the rest of your money?

JFF helps you take control of every dollar you make so you can maximize savings, eliminate debt, and ensure your income is being used in the best way possible. The strategies we teach go beyond investing and give you a full wealth-building roadmap.

I don’t have time for another course. How much time will this take?

JFF isn’t just another course. It’s a hands-on, action-focused program designed for busy, high-achieving individuals who don’t have time to waste.

The systems we give you take just 1-3 minutes a day to use, and we provide clear, step-by-step guidance so you’re never left wondering what to do next. The more you implement, the faster you’ll see results.

What if I’m already doing well financially?

Making good money is one thing – keeping it, growing it, and making it work for you is another.

JFF isn’t just for people struggling with money; it’s for those who want to maximize their earnings, grow their wealth faster, and build financial security that lasts a lifetime. If you’re ready to take your finances from “doing well” to financial freedom, this is for you.

Is this program only for business owners?

No – JFF is for anyone who’s making good money and wants to master their finances.

Whether you’re a high-earning employee, an entrepreneur, or somewhere in between, the strategies we teach apply to anyone looking to create financial security, save and invest strategically, and build wealth for the long term.

Can I afford this?

The real question is: how much is it costing you to not have a plan?

If you’re making good money but still feel like you’re not getting ahead, then something needs to change. JFF is designed to help you get your money working for you so you can save more, pay off debt faster, and invest strategically, making back your investment many times over.

What kind of results can I expect?

While results vary depending on how you implement the program, many of our students:

✅ Increase their savings by 50% within 90 days

✅ Pay off debt twice as fast as they expected

✅ Build additional income streams that don’t require more work

✅ Start investing with confidence instead of putting it off

✅ Finally feel at peace with their money

If you’re ready to feel in control of your finances and start seeing real, tangible progress, this is your next step.

Is There a Payment Plan?

We’ve intentionally designed this offer to maximize your results and that’s why we’re only offering one simple, high-value option:

$6,000 for 6 months of coaching and mentorship, and access to all learning materials and community.

But for this event only, when you pay in full, we’re doubling your access. That means:

✅ 12 full months of coaching, guidance, and support

✅ 12 months of 1:1 coaching and strategy calls to ensure you’re making real progress

✅ 12 months of access to proven financial systems and strategies that help you save more, invest smarter, and build lasting wealth

This isn’t your basic course – it’s a high-touch coaching experience designed to help you implement and see real transformation in your finances.

Still have questions?

Reach out to us at [email protected], and we’ll be happy to help!

Copyrights 2025 | Journey to Financial Freedom | Terms & Conditions